Last update : 7th Feb 2023

First of all, Welcome to Korea. I have written this page to let you people planning to stay or live in Korea know some tips on bank account opening in Korea. There are many reasons for coming here, but I guess you're reading this because you're going to study, work, do business, marry a Korean or immigrate to Korea somehow. So I've written this page for those long-term residents and immigrants. For your information, short-term visitors with less than a 3-month stay can open a bank account in Korea, but the bank will restrict money transfers from your account and your account access through ATMs and the Internet banking system. Also, some banks won't allow non-residents to open an account. Hence, unless you have a bunch of cash and a long-term visa, I don't recommend you open an account with a short-term visa in Korea.

I can't be sure who you are and where you are from. Maybe some of you did banking in your home country as a part of your life, Or never had experienced banking in your home country. But if you want to be a long-term resident in Korea, banking is necessary because immigration will ask you for your bank statement when you apply for a new visa or visa extension. Also, since banking is a big part of life in Korea(Because it's easy to waive the fees and interbank money transfers are instantly done.) and over 95% of Korean people have their bank account in Korea, it may be helpful when you interact with Korean people. But don't worry, it won't be that hard and it will cost nothing or only a little.

How to choose your banks

Unlike Korean citizens, foreign residents have some restrictions on using online services. So it'd better choose your first bank near your home, your school, and your company so that you can easily visit there whenever you want. If you're going to work for a company or school, you'll possibly be asked for opening a bank account from their main bank to get paid. In this case, you'll open and use your company's main bank first. If you don't like the bank or need to use another bank, you can open another account from a different bank on your own. Since Korean commercial banks don't charge a monthly service fee, you can have multiple bank accounts without any cost.

What you need to prepare

Before visiting a branch, you need to take the following documents. To verify

your identification, you'll need ...

- Alien Registration Card(외국인등록증). If you've applied for an ARC and not received it yet, you can bring your Certificate of Fact on Alien Registration(외국인등록사실증명서) instead. But some banks won't accept this document.

- Your passport with a valid long-term visa(유효한 장기체류 사증이 있는 본인 여권)

- Korean Driving Licence(한국 운전면허증)

- If you're an American citizen, your Social Security Number is required.

In most cases, one of those will be enough to start banking, but it'd better take both your ARC and passport because some banks could ask you for both of them. If you've got a Korean driving licence, that must be OK. If you acquired Korean citizenship, of course, you can show your Resident Registration Card(주민등록증). Some banks will take your NHIS card(건강보험증) and other ID cards too. Also, they'll ask you for one of

the following documents too. :

- For business owners: Certificate of Tax Payment(납세증명서), Business Contract(사업거래 계약서 등). Company Registration(사업자등록증) is required.

- For workers: Certificate of Employment(재직증명서), Payslip(급여명세서), Labour Income Withholding Receipt(근로소득원천징수영수증), Certificate of National Health Insurance Service Subscription(건강보험자격득실확인서). The bank will check if you actually work for your company over the phone.

- For others: Tuition invoice(등록금 고지서), Utility bill(공과금 청구서), Mobile phone bill(휴대폰 요금 청구서) and etc.

Some bank branches might reject some of those documents OR some branches won't ask you for any of them, It's kind of a hit or miss. If possible, I suggest you contact the branch you want to visit. Those documents must be the originals.

The bank could ask you for

some small amount of cash(Perhaps up to 10,000 ~ 20,000 KRW) for the initial deposit.

Then, it'd be better to

search for an account plan and a check(debit) card beneficial for you in advance, so that you can ask the bank that you want to sign up for the products chosen by yourself.

When you open a bank account in Korea, you'll discover one big difference between Korean and western banks, you can't open a current(checking) account in Korea, especially as a foreigner. Most Koreans just open an ordinary(or savings) account for their day-to-day transactions and you'll have the same one. It's because Koreans move their money and pay through internet banking quickly and people don't prefer(maybe don't know) accepting a personal cheque since it's risky. Therefore, you can't issue a cheque in your name in Korea. In case you can't move your money through the internet banking system due to its transfer limit, you can get a cashier's cheque(자기앞수표) from your bank.

So you will never need a current account in Korea at all unless you operate your own business in Korea. Just an ordinary account will be enough.

| Account type

|

Account type in Korean

|

Detail

|

(Individual) Current account

Chequing account

Checking account

|

(개인)당좌예금

|

You can freely deposit and withdraw your money. You can write a cheque(수표). Requires a good credit score.

|

| Ordinary account

|

보통예금

|

You can freely deposit and withdraw your money. This and the following are what most people in Korea have.

|

| Savings account

|

저축예금

|

Same as an ordinary account. However, you can't open this one as a corporation.

To avoid confusion, you should tell the teller that you want to open an 입출금자유예금(ordinary account) when you open a new account .

|

| Fixed savings account

|

정기예금

|

Only for saving a large sum of money like a CD(Certificate of Deposit). You can't deposit and withdraw money. You can only withdraw the money by closing the account. It offers you an interest rate for a certain period.

|

| Instalment savings account

|

적금

|

You can only deposit your money but can't withdraw money. You can only withdraw the money by closing the account. It offers you an interest rate for a certain period.

|

Also, another different thing from the banks in other countries is that Korean banks have a lot, A LOT of different types of debit(check) cards, unlike most of the banks in your home country that have only a couple of debit cards. If you explored my website, you might discover each bank has more than 5~10 debit(check) cards. Basically, They all work in the same way. You can buy something in a shop with it and use an ATM with it, but they just offer different benefits. You can have one of them or ALL of them. Some card companies limit the number of total active cards you have in that bank but you can have more than one if you want.

In a branch

Now you can go to a bank branch. You don't need to book in advance and you can get there whenever you want. Most of the branches open at 9 o'clock and close at 16 o'clock on weekdays and they don't open on weekends, except for a few designated branches. Standard Chartered Bank Korea branches are open until 16:30. If you want to get it done quickly, avoid visiting there between 12 and 13 because the branch will be busy and packed with other customers. Some unpopular banks, such as KDB and Suhyup, won't be crowded even if you visit them at lunchtime.

|

|

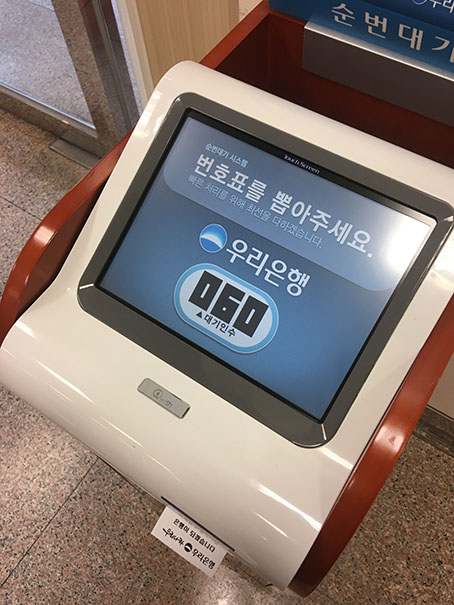

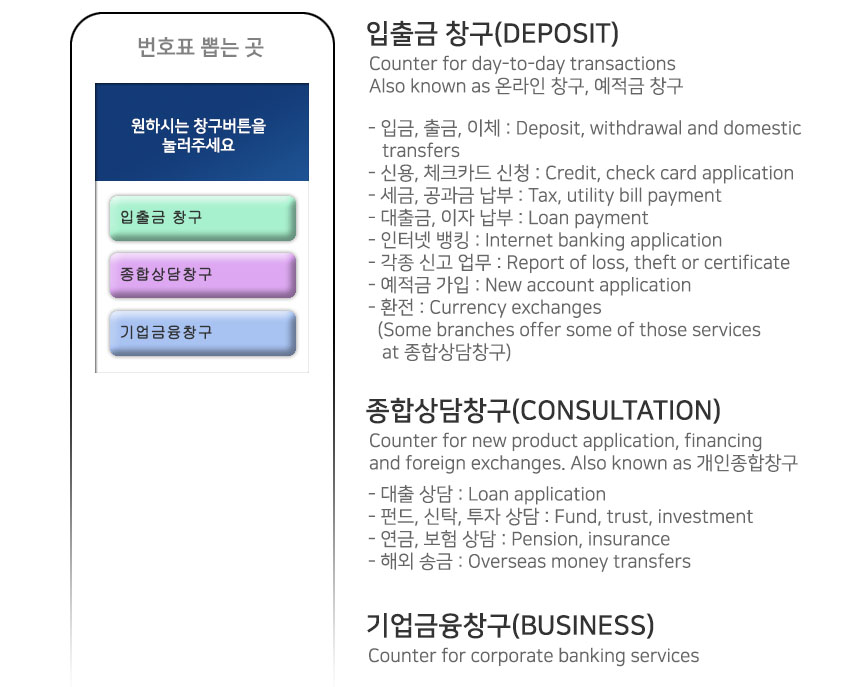

| Ticket dispenser

|

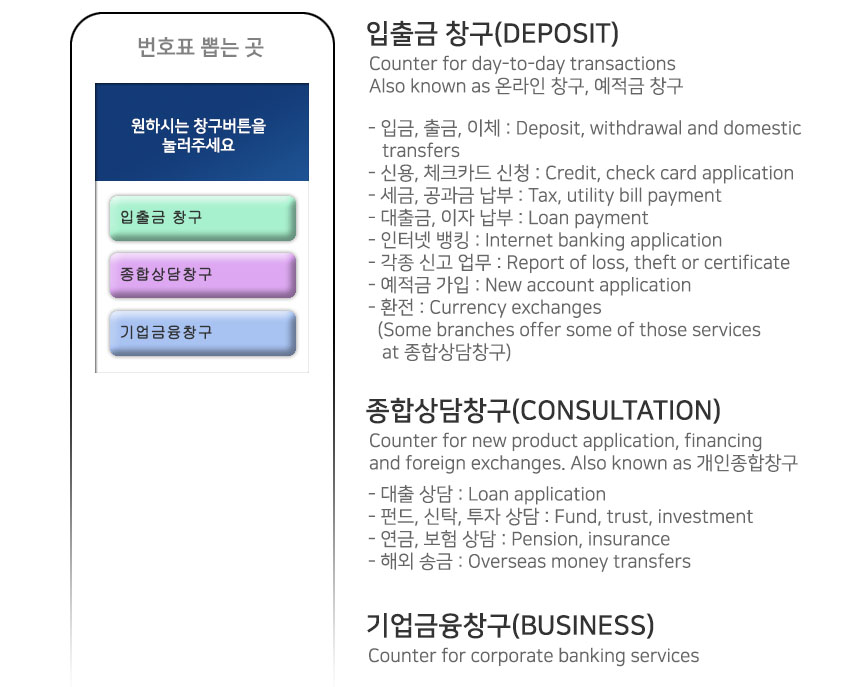

Ticket dispenser with multiple buttons

|

Once you enter, there will be a ticket dispenser next to the entrance. Get a ticket from it. Some bigger branches will have two ticket dispensers or a dispenser with multiple buttons. In this case, push or choose '입출금 창구', '예적금 창구', '온라인 창구', or '개인업무' and get a ticket. '(종합)상담창구' is also OK for some bank branches. In a Post office, you have to choose '금융창구' or get a ticket from a dispenser at '금융창구'. If you're not sure, you can ask a security officer standing at the entrance and they'll guide you. Repeat it whenever you visit the branch. Usually, you'll have to get a ticket for '(종합)상담창구' if you want to transfer money abroad, sign up for an investment product, or apply for a loan.

There'll be a number on your ticket. Wait until your number is called and shown on the number screen. Then, go to the teller who called you and tell him or her that you want to open a new account. KEB Hana, Citi, and SC Bank may have at least one or more English-speaking tellers in each branch. If you don't speak Korean and the teller doesn't speak English, he or she will ask another teller to deal with you. If there's no English-speaking teller, the teller will use his or her telephone to connect to and get help from an interpreter. But there are some cases where you can't get an English service or get an incomplete service in English. So If you speak the Korean language, it will be a huge benefit on getting such services from them. Even if your language isn't fluent, The teller will explain in easy Korean to let you understand.

Account opening

Submit the documents you've prepared. If there's a missing or improper document, the teller will tell you what you need to bring. In this case, you can't open an account and you have to go back to bring an additional document. Otherwise, the teller will give you some papers and ask you to fill out the forms. You don't need to fill out all of the forms. The teller will mark some fields of the forms they need to get. You just need to write your information only on the marked fields and return the form to the teller.

Don't forget to ask the teller for a specific account plan that you want. You may have searched for a beneficial account plan for you before visiting. Ask the teller then he or she will let you have it. If you don't, the teller will pick one for you and it will possibly come with nothing or with fewer benefits, and you'll have to pay the banking fees that you wouldn't need to. But there are some cases you can't specify the account plan. The first case is the account plan you chose is unavailable in offline branches. In this case, you can open an account with another plan, and then switch it on their online banking system. But still, there are some account plans even not available for switching. The second case is if the account plan requires a specific document. For example, in some financial institutions, you have to submit any document that proves your employment, not a billing invoice, business registration, or something else to open a worker's account plan. But this case doesn't commonly happen.

After submitting the forms, the teller will ask you for your signature on your new passbook. If you're Japanese or Chinese and you brought your seal(印章) from your home country, you can use it instead of your signature.

When you get a paper with an account number or a passbook, it's done. Congratulations! You have a new bank account in Korea.

Getting a check(debit) card

You can deposit, transfer and withdraw your money with just a passbook and it works with ATMs too, like a debit card or ATM card. But still, it's not comfortable to use just your passbook, because it will only work with the passbook issuer's ATMs. For instance, the Wooribank passbook will only work with Wooribank ATM. And some of you have used your debit card back in your home country and you may want the same.

Of course, you can get a debit card while opening a new account. In Korea, it's called 'Check Card(체크카드)', rather than 'Debit Card(직불카드)'. A check card will bring you some benefits and let you perform banking transactions easily. Here are the benefits of getting a card. :

- You can buy something from online and offline shops in Korea and overseas, without carrying cash. But it won't work if you don't have enough balance for buying something since your account is not a current account and won't be overdrawn.

- You'll get cashback, and point reward benefits of your card. "Cashback" means the card company/bank will give you a part of your check card spendings back in cash.

- You can access and perform banking transactions with your account at any ATM around the country, and even eligible overseas ATMs too.

- Some check cards have built-in transport cards. So you don't need to buy a T-money or Cashbee.

- In some other countries, the banks will charge you extra fees if you make more debit purchase transactions with your debit card. In Korea, if you buy goods from stores and pay bills with your check card, the banks will never charge you additional fees no matter how many purchases you make.

To apply for a check card, just ask the teller. If you ask when you start the account opening, the teller will take care of them at the same time and finish it earlier. Perhaps the teller could ask you first. Some bankers won't let you apply for a check card because of security reasons and they'll tell you when you'll be able to apply for a card(3~6 months later). If they say it's OK to apply, then you'll have to fill out the check card application form.

The application fee will be free in almost every bank. But NH will charge 1,000 KRW for adding ATM access functionality to your check card. BNK Kyongnam, Busan bank, and DGB Daegu bank will charge 1,000 KRW(Except for some eligible check cards). Citibank Korea will charge

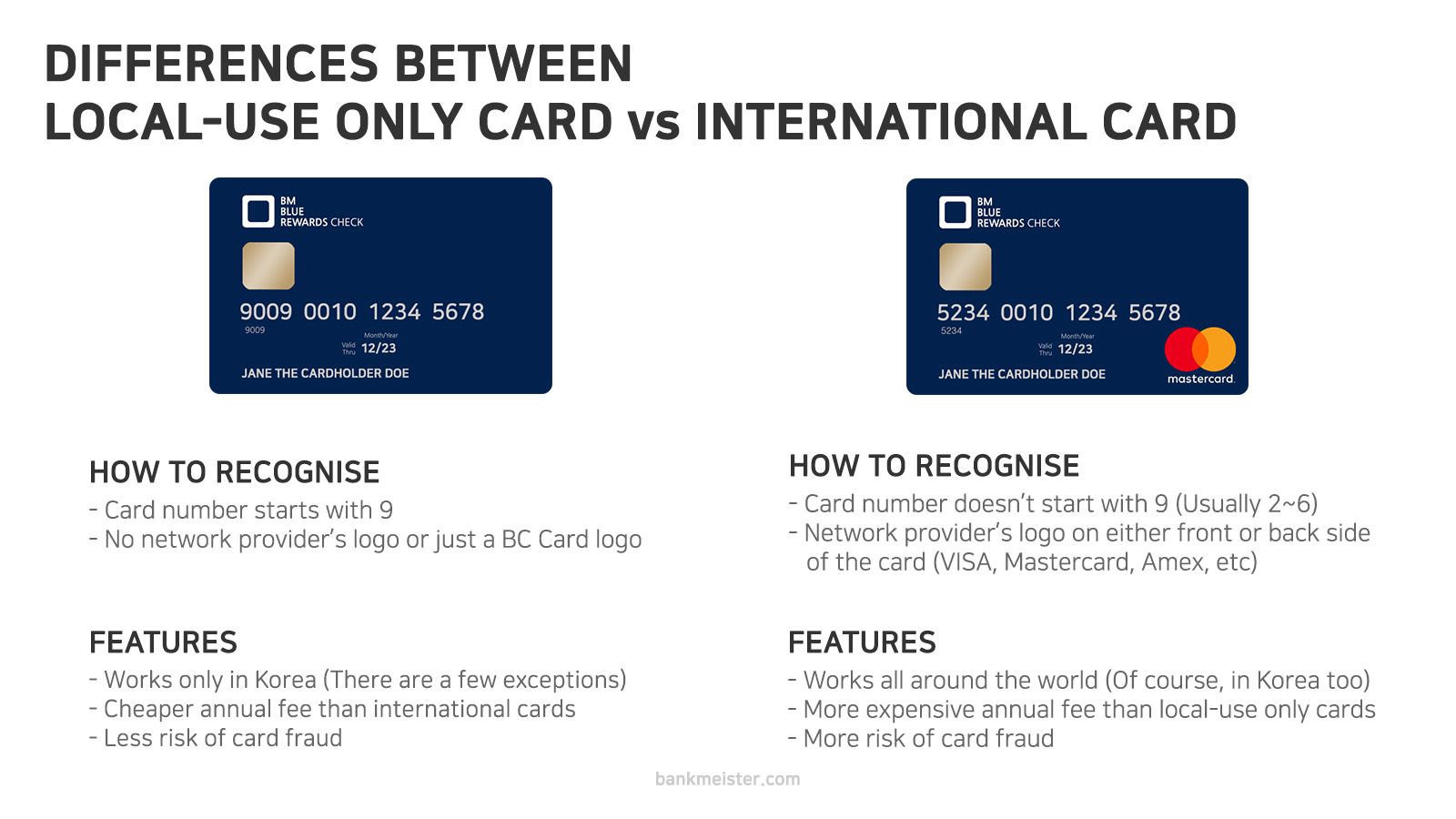

50,000 KRW(≒ USD 43) for a new Mastercard check card! If you want a check card from Citibank Korea, get a local-use-only check card, which is free.

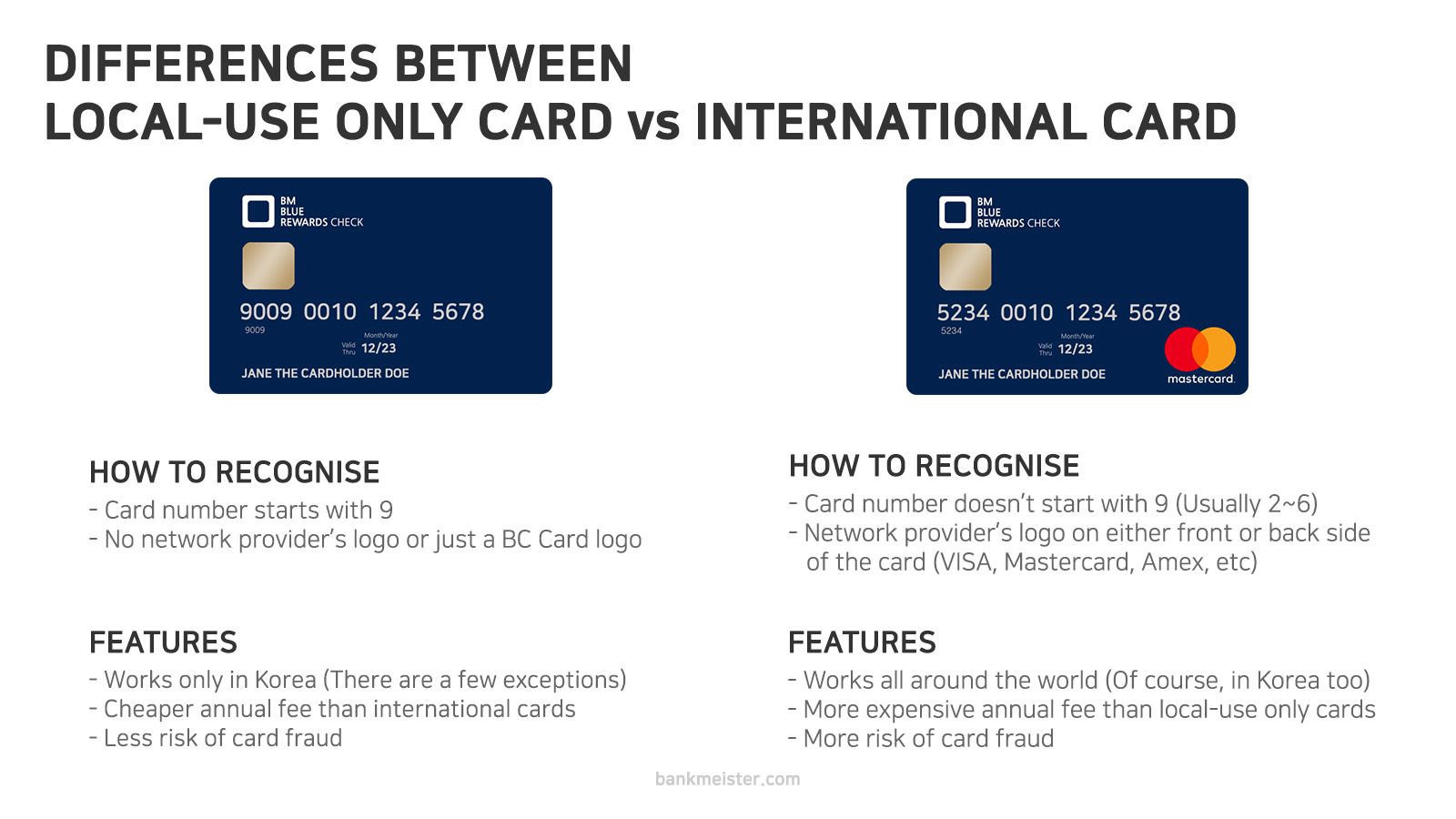

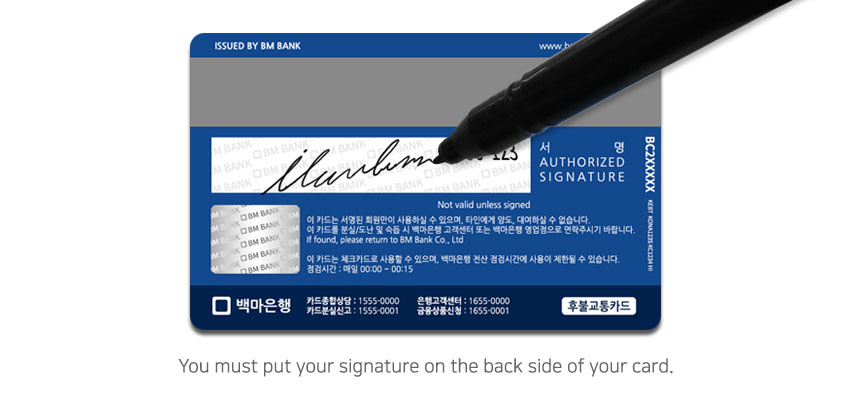

If you want to use your card abroad, you must inform the teller. Although some check cards don't work abroad even if you ask them for them. If your card number starts with 9, that's a local-use-only card, which works only in Korea. Very soon after completing the form, they'll give you a new check card. If they don't have a prepared check card for issuance, your new card will be delivered in 3~5 business days to your home, workplace, or bank branch according to your selection. Once you get a new card,

put your signature on the backside of the card. If you want, you can write your account number on the backside of the card, so that you can let other people know easily.

Signing up for e-banking system

Internet banking will let you see your balance and move your money without visiting a branch or ATM. Even at night, if a friend asks you for some money, you can give the friend money without leaving your home. It will surely make your banking much more convenient and save some banking fees, so I suggest you apply for Internet banking. But like applying for a check card, some bank branches won't let you apply for it for a certain period due to their security policy. Applying for an account in the internet banking system is free and the bank won't charge a fee for maintaining your internet banking account.

You'll be able to apply for it as you open an account, of course, you'll have to write some papers. After filling out the application form, you'll receive a code card. This code card, called 'Security card', 'Secret card', or whatever, is used when you transfer your money to another account. The bank website will ask you for a couple of numbers on the card. (Remember, the real bank website will ask you for

only a couple of the numbers. If they ask all of the numbers, stay away from them!

That must be a SCAM!!! and scan your PC with anti-virus software.)

If you use the code card for transfers, you can transfer up to 10 million KRW a day, 50 million KRW a month, unless your account has a lower transfer limit. If you worry someone could steal the codes on the card or if you find the transfer limit is low, you can consider buying a One-Time Password authenticator("OTP"). Unlike code cards, the OTP randomly generates a 6-digit number every minute. So it's safer than a code card especially when someone stole the authentication code for a money transfer. Moreover, once you get an OTP, you can raise the domestic money transfer limit up to 100 million KRW a day, 500 million KRW a month. But it's not free and you have to buy it from a bank. An OTP token, in the form of a USB flash drive, usually costs 5,000 KRW. If you want to put it inside your wallet, you'll have to buy an OTP card, which costs 13,000 ~ 15,000 KRW. Fortunately, if you buy an OTP from one of your banks, you can use it in all of your different banks. You don't need to purchase extra OTP for each bank. I suggest you buy the main OTP and backup OTP. The OTP tokens from OpenSpan(Formerly "VASCO") are more popular with their quality and durability than Mirae Technology. Your OTP will last 5~7 years.

When you complete signing up for Internet banking, the teller will give you a code. The code will be the key to signing in for the first time. If you lose the code or the code expires, you need to visit the bank again, so keep it carefully.

Now, you're going to connect to the bank website, which brings some Active-x craps and ruins your PC. It'd better connect to the bank website on your work PC or virtual machine. If there's no other PC you can afford, remember the software names installed when you visit the bank website, then delete them all after setting up smartphone banking.

Go to the bank website and create an ID. The website will ask you for certain personal information. The code you have received will be used at this moment. If you see your accounts and balance, you've successfully signed up for Internet banking.

Still, you can't move your money. To move your money, you must apply for a digital certificate(인증서) and download it. Go to the Certificate Centre(인증센터) and you can apply for a new one. The application fee is free. But if you want to use your cert on non-financial websites, such as govt website, you need to apply for a general digital certificate(범용 공동인증서) which costs 4,400 KRW.

| Type of certificate

|

Issuing/Renewal fee

|

Works with

|

Stored in

|

Financial certificate

(금융인증서)

|

Free

|

Website and mobile application of banks, brokerage firms, insurance companies, credit card companies and other financial institutions

|

Cloud storage run by KFTC

|

Digital certificate for financial institutions

(금융기관용 공동인증서)

|

Your PC or removable local storage

|

General digital certificate

(범용 공동인증서)

|

4,400 KRW

|

All govt websites, telephone companies, universities and all financial institutions (There are a few exceptions)

|

Your PC or removable local storage

|

When you connect to the bank website, you'll see there's '인증센터' or 'Digital Certificate Center' somewhere on their main page. Click on it, then click on 'Issue/Reissue Digital Certificate'. You'll be asked for some information registered in the bank, enter all of your information. The information they ask you will vary with banks. (

NH Bank Official Guide for Issuing a digital certificate) When it's completed, the website will ask you which storage you want to store the new digital certificate.

Digital certificate files are downloaded and stored in your PC hard drive, external storage(eg: USB Flash Drive, External HDD), IC Card, and other eligible storage. I'd suggest you save your digital certificate into your USB Flash drive because it allows you to do banking outside. You can copy the files into your PC and you can do banking without a USB Flash drive, but it's not recommended for your security.

Then it's done. Now sign in with the new digital certificate and now you can move your money.

Paying rent and utility bills

Most of you might get a monthly rent and of course, you'll have to pay the utility bills of that apartment. In Korea, people usually pay their rent through bank transfers. When you make a house contract, there'll be a landlord's account number on the contract paper. You can simply pay your monthly rent by transferring your money into that account. If you don't have an account yet, you can pay the rent or deposit in cash by visiting a branch or using an ATM. If the house management office is large enough, they could accept credit/debit cards for paying rent.

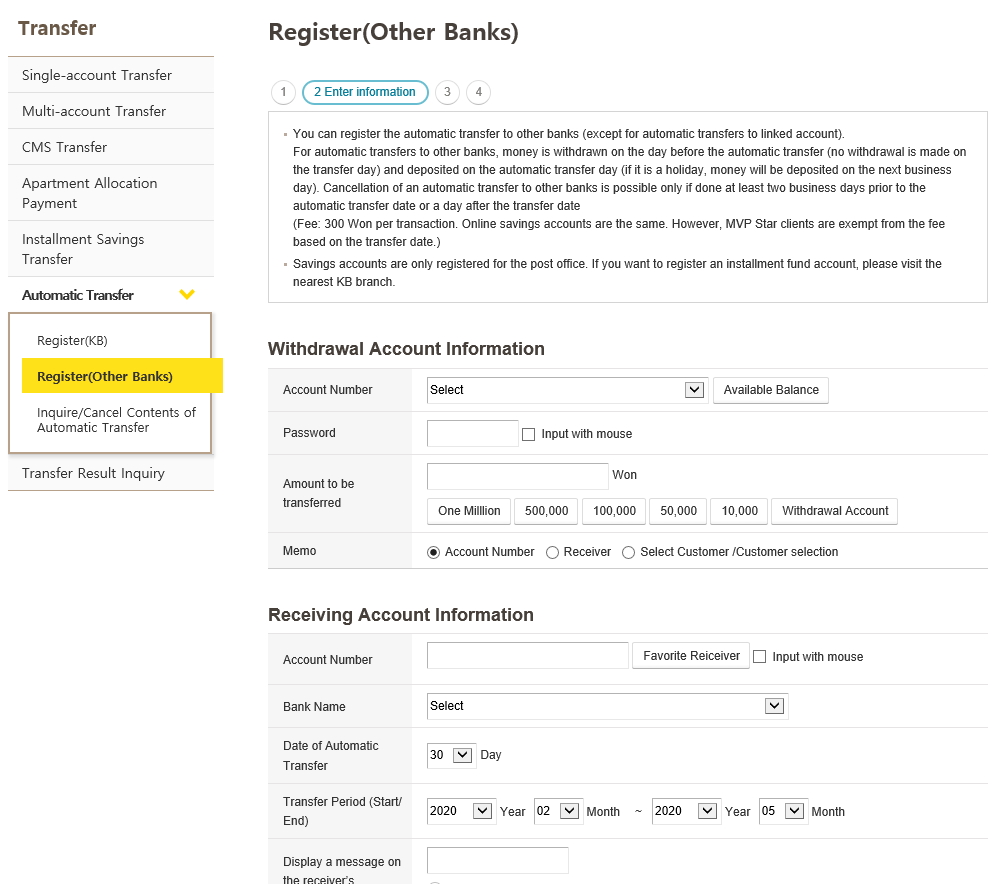

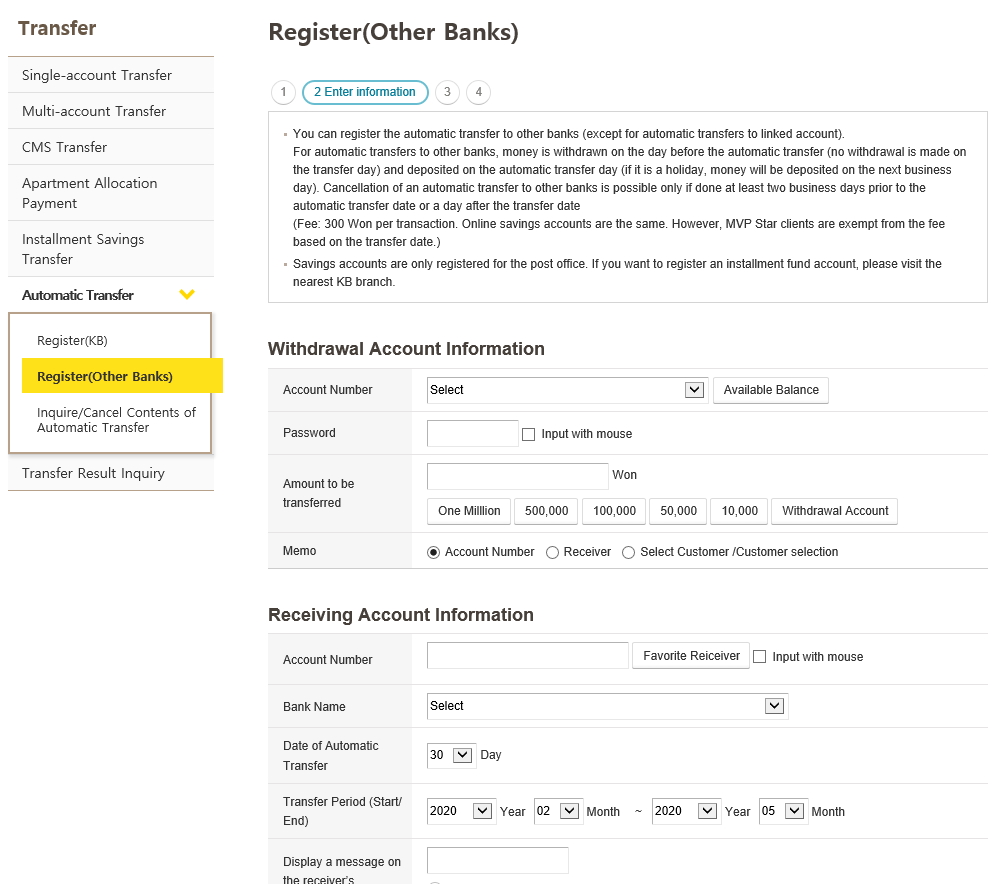

Basically, rent is one of the fixed expenses. You have to pay the same amount of money on the same day every month. Hence, instead of internet banking or ATM money transfers, there's an easier way to transfer the money: Scheduled(Automatic) transfer(자동이체). You can simply set it up by visiting a branch or you can do it on your own if you've signed up for their internet banking. After setting it up, the money will be debited to the landlord's account on the scheduled day. If the day is a holiday or weekend, it will be postponed until the next working day. The fee is 300 KRW per transfer which is cheaper than a manual transfer. Of course, some account plans will get rid of the fee.

|

| Scheduled(Automatic) transfer application form of KB Bank(Online)

|

TIP: When you get a new rental apartment, I recommend signing up for fire insurance(주택화재보험). If you burn your apartment by accident, you'll not just have to buy your new stuff but also have to compensate the landlord and other neighbours for damage which usually costs more than a couple of 10 million KRW. To prevent this kind of financial loss, getting insurance is not a bad idea. You can sign up for it through a salesperson or a bank branch. Short-term insurance will cost only a couple of ten thousand KRW and long-term insurance will return some of your payment if it's expired without an accident.

But for the utility bills, different amounts of bills will be charged every month. Instead of a scheduled(automatic) transfer, you can set up a direct debit for it(공과금자동이체). This won't charge a fee but some of the account plans will waive your banking fees. It's much more beneficial than manual transfers. Or you can pay the utility bills with your credit/debit card(Except for a few gas companies).

Do I have to open a second account in another bank?

It is up to you but I strongly suggest you open another one in another bank. Here's why:

- Perhaps you'll need to get a certificate of deposit balance to prove your funds to the immigration office whenever you extend or switch your visa in Korea. When you issue the document, your money in the account will be frozen and you can't make any transaction with the account on the issuing date and until tomorrow. If you have another account, you can continue banking with it.

- When a new product is launched, you can sign up for this easily.

- You can experience and compare the products and services between those banks and you can choose a better one easily.

- Some shops and card issuers offer special deals for specific credit/check cards. (Eg: KB Card offers a free coffee voucher for using their VISA check cards of more than 10,000 KRW until 14 Sep.) You'll be able to get more chances to apply for this kind of benefit if you have more accounts and cards in different banks.

- Some banks could shut their system down from several hours to several days for maintenance. If you have another account, you don't need to think about where you can keep your cash during downtime.

However, you're not allowed to open another bank account right after account opening. According to the govt policy, you have to wait for 20 working days and after that, you can open another one. This rule applies to only KRW ordinary and savings accounts(자유입출금예금) which let you deposit and withdraw money whenever you want. Fixed savings accounts(정기예금), instalment savings accounts(적립식예금) and foreign currency accounts(외화예금) are not applied.

Is there anything else need to know?

You should keep your accounts active. If you leave your account inactive for a long time, the bank will suspend it. The period will depend on its balance. Here's the reference table :

| Inactivity period

|

Balance

|

Note

|

| 1 year(=12 months)

|

Less than 10,000 KRW

|

6 months for Shinhan Bank accounts

|

| 2 Years

|

Less than 50,000 KRW

|

|

| 3 Years

|

Less than 100,000 KRW

|

|

| 4 Years

|

100,000 KRW or more

|

Applies to Citibank Korea only

|

THIS RULE APPLIES TO ALL COMMERCIAL BANKS IN KOREA. So you should maintain the balance of over 100,000 KRW in your second account if possible, Or make a money transfer once every half-year to prevent it from being suspended.

If your account is suspended after a long inactive period, you can make it active again by submitting eligible documents that are used for account opening. Of course, you have to revisit a branch, and it can be refused. It's kind of a hassle so be careful.

And remember this: "

NEVER HAND OVER YOUR PASSBOOK OR CARD TO SOMEONE ANOTHER AND DON'T LET SOMEONE ANOTHER KNOW THE PIN CODE OF YOUR ACCOUNT." Especially, giving your passbook or card will make you subject to

criminal punishment (Relevant laws: 전자금융거래법 제6조, 제49조). It's because by letting that person uses your account, the person can commit crimes and evade the authorities easily.